- You spent a lot of money on that sofa 5 years ago but it doesn’t work in your new home.

- You loved it when you bought that suit but it doesn’t fit your personality anymore.

- Your best friend talked you into buying that clock last year but it’s just not you.

- Your husband gave you a gift because he thought it was meaningful but it’s simply not your taste.

Sound familiar? What do you do?

First, forget how much you spent on it or how much it may have cost. That money is gone.

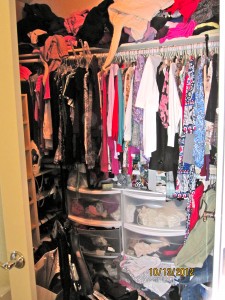

Second, it won’t serve you tucked away in some back cabinet or closet especially when you need that space for other items.

Once you’ve realized the cost of holding on to it exceeds the cost of letting it go, you have two options.

- Donate it

- Sell it

Keeping it is an option if you want to delay your decision even longer but that’s the very definition of clutter.

“Gifting” it to someone else is also an option but be careful that you are not simply transferring your clutter to someone else. In this case I consider “gifting” the same as donating.

The next thing you should do is decide on a dollar amount that would make it worth your time to sell it because selling an item takes a lot longer than donating. And donating takes time too.

Would you take the time to sell it if you made $10? $50? $100? More?

Let’s say for example you have an artsy, hand-painted table you bought fifteen years ago when you were living as a single person somewhere else. Now you are married and working full-time. It’s still in good shape but it no longer fits your more streamlined, contemporary style (or your spouse hates it). Now there’s no place to put it so it’s just taking up space in your garage.

Let’s say for example you have an artsy, hand-painted table you bought fifteen years ago when you were living as a single person somewhere else. Now you are married and working full-time. It’s still in good shape but it no longer fits your more streamlined, contemporary style (or your spouse hates it). Now there’s no place to put it so it’s just taking up space in your garage.

You paid almost a thousand dollars for it so you can’t imagine donating it. Your kids don’t want it and you don’t have the time to refinish it.

You’ve already taken the time to find out similar used tables sell for about $200-$300.

If you decide to sell it you will need to be prepared to spend at least a couple more hours selling it. You can do this on sites like Craigslist, Amazon or Ebay, including the time to reply to emails, be available to meet with prospective buyers and sell it in person, assuming you don’t plan on shipping it.

If you’re lucky it will sell for the price you want. If not, it’s still taking up valuable real-estate in your garage, not to mention space in your brain.

You can also donate it to a charitable organization such as Goodwill. Alternately you can donate it to a specific local charity or non-profit organization you are connected with for a fund-raising auction. Again, this will take time, more time depending upon which type of donation you choose. You can also consign but keep in mind consignment shops have the last word on whether or not they will take an item. You could end up going from store to store and still not get anyone to take it. Be sure you know and understand a consignment store’s policy before you go there.

Most people tend to overvalue the worth of their possessions. Not everyone will have a seemingly worthless vase that really is a priceless collector’s item like the ones on TV’s Antiques Roadshow.

When deciding whether or not to donate or sell, you’ll want to obtain the true estimate value of an item or items to help you decide.

Donation is not the same as disposing. When you donate an item it does continue to have worth, both tangible (the tax benefit, re-sale value) and intangible (the ‘feel good’ effect). Incidentally, the IRS allows for up to $500 of non-cash donations to be claimed on your taxes without having to provide proof of value for each individual item.

Does this mean you should donate the table? Not necessarily but it does depend on other factors:

- Do you have the time and willingness to sell it?

- Do you need the income right now?

- Is the item worth your time to sell given it’s actual estimated market value?

- Will donating now versus waiting to sell it help with other goals you have such as gaining more storage or more room for another hobby or interest?

If you consider all of these factors together, chances are you will know what to do. If you’re still stuck, consider asking the advice of a professional organizer or call LET’S MAKE ROOM.

We can help you make a decision you can live with.